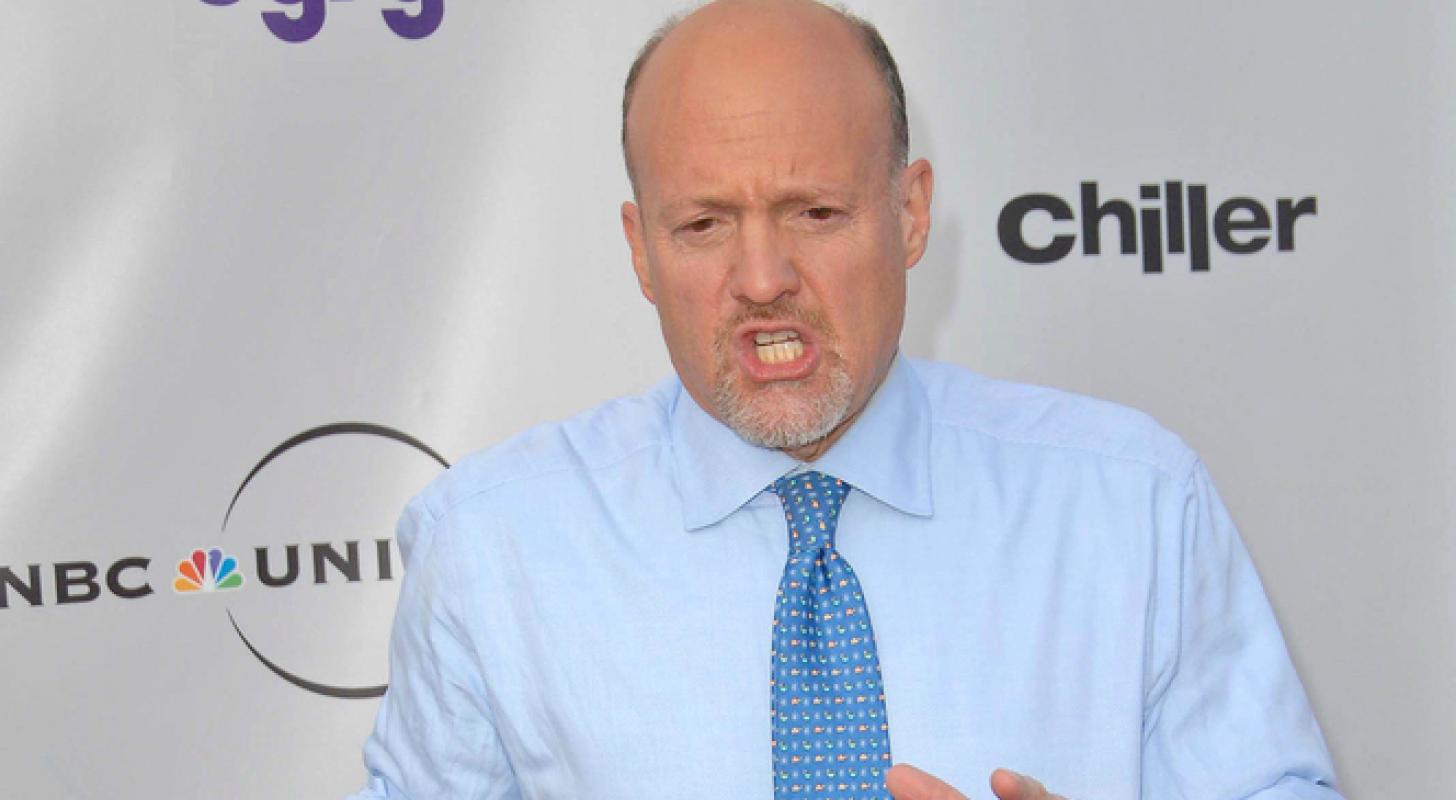

Prominent market commentator Jim Cramer has sounded a word of cautionand said market volatility is likely to continue as the recent run loses momentum, according to to a CNBC report.

“The diagrams, interpreted by Jessica Inskipsuggest that if we exit bear market rally mode, the broader market could be in for a bumpy ride,” he said.

Also read: Gold IRA Kit

Wall Street’s main indices closed over 1% lower on Tuesday, continuing Monday’s downtrend. Concerns over a recession weighed on investors after stronger than expected economic data sparked speculation federal reserve will continue its rate-hike path, increasing the likelihood of a recession.

That SPDR S&P 500 ETF Trust SPY closed down 1.44% on Tuesday during the Vanguard Total Bond Market Index Fund ETF BND ended up 0.33% higher.

Chart Analysis: Cramer highlighted the daily chart of the S&P 500 to explain Inskip’s analysis. “Inskip believes the market’s gains from mid-October through late last week were a bear market rally — in other words, a temporary bounce in a larger downtrend,” he said, according to the report.

The expert also noted that the market is at its mercy Federal Reserve rate hikesand the central bank’s inflation strategy is committed to the labor market, the report said.

“Inskip believes we’re right back into bear market mode,” Cramer said, adding, “The S&P can still escape this new trajectory, but it won’t have much confidence in a bounce unless we compare levels from last.” Break through Friday.”

Continue reading: Tesla, Apple, MongoDB, GameStop, SentinelOne: Why these 5 stocks are capturing the attention of retail investors today

[ad_2]

Source story