From May to June of this year, cryptocurrencies experienced what industry insiders are calling the “Lehman Brothers Collapse.” “Crisis” events included the collapse of South Korea’s stablecoin Terra, the “LUNA death spiral”, suspension of account withdrawals by crypto lending company Celsius in preparation for bankruptcy, and the liquidation of crypto hedge fund Three Arrows Capital.

Crypto market sentiment was equally sour, falling for dozens of straight weeks on a series of negative events before staging a rally in July when the US Federal Reserve’s rate hike landed. Exchanges have been even worse, and as a venue for crypto asset flows and price discovery, they too have taken an unprecedented hit.

People had to live with it because everything was unexpected.

At the macro level, the current poor market conditions will not have any long-term impact on the prospects and growth of the crypto industry, so the focus for exchanges is actually quite clear: to survive, and the premise of survival is to solve the difficulties of user retention and the high cost of developing new users.

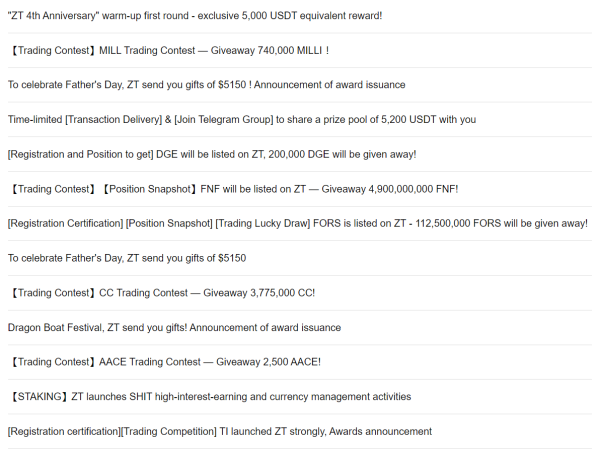

In the current bear market, however, ZT’s performance has attracted attention. In terms of business, ZT focuses on spot trading and does not introduce leverage and contract products, instead using ETF leverage tokens to fill the derivatives gap. ETF leveraged tokens have the advantages of a low capital threshold, low operational expertise requirements, no margin and no risk of blowout. For new users in the market, ETF leverage tokens are the best way to experience ETF leverage tokens. For new market users, ETF leveraged tokens are one of the best ways to experience crypto assets and make them a more trusted trading asset for users.

From an exchange perspective, in the current bear market, if you want to attract new users, you still need to dig deep into the market with money-making hotspots, and ETF leveraged tokens are undoubtedly a better choice.

From April 15, 2022, the platform will…

[ad_2]

Source story