Berkshire Hathaway, Inc BRKA BRKB Fourth quarter earnings report Data released on Saturday showed that the investment holding company’s liquidity position at the end of the year rose from September levels.

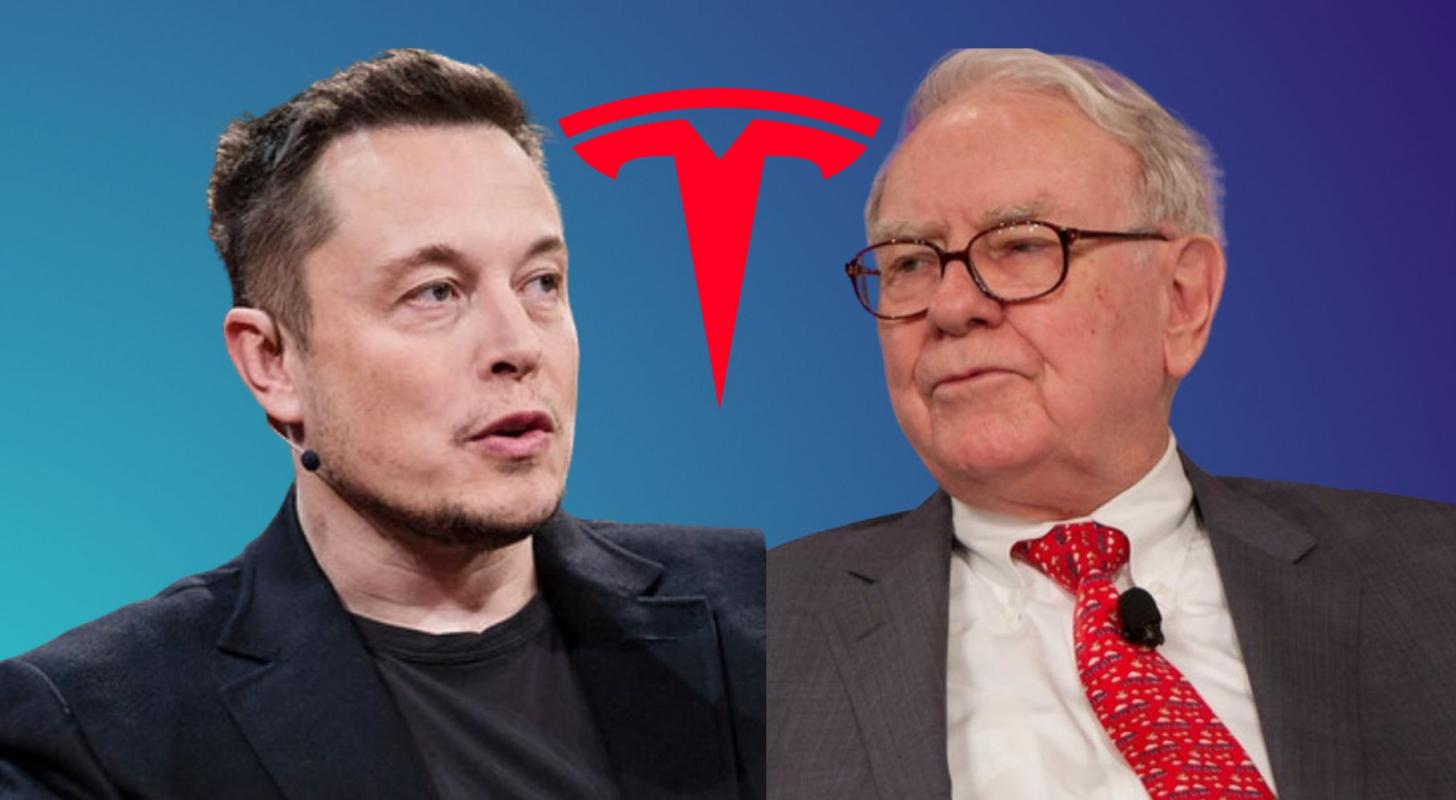

What happened: Tesla TSLA CEO Elon Musk offered an opinion on investing the cash reserves of the Warren Buffettmanaged company. He responded to a trader’s tweet asking for opinions on the stocks Berkshire can buy with its more than $128 billion in cash.

“Starts with a T…” the billionaire replied, apparently referring to his flagship electric vehicle company, Tesla.

Musk followed it up with a tweet saying Charlie Munger had a choice to invest in Tesla, valued at around $200 million, almost 15 years ago when they were having lunch together. Munger is Buffett’s trusted lieutenant and second-in-command at Berkshire in his capacity as vice chairman.

This isn’t the first time Musk has recounted the incident between him and Munger. In response to a February 2022 tweet, the Tesla CEO said he did Lunch with Munger in 2009, as the latter discussed all the ways Tesla would fail. While he agreed with Munger that Tesla might fail, Musk apparently said it was still worth trying.

See also: Everything you need to know about Tesla stock

Why it matters: Musk’s rendezvous with Munger, according to the timeframe mentioned above, apparently took place before Tesla’s IPO on June 29, 2010. Since then, Tesla has grown in rank and is currently a mega-cap company with a market cap of around $623 billion. Tesla bull Cathie Wood expects the stock to hit $500 by 2026, up from the current $196.88 if you only consider the EV part of Tesla’s story. If the possibility of autonomous driving is also taken into account, the Stock could rise above $1,500, She said.

Meanwhile, in his annual letter to shareholders, Buffett said that Berkshire will hold a boatload of cash and U.S. Treasury bills, along with…

[ad_2]

Source story