[ad_1]

The team behind Truflation, the world’s first independent US inflation metric, has released 16 new NFT price indexes for major NFT collections, including BAYC.

Truflation’s newest indexes were announced at the Consensus 2022 conference in Austin,TX by Truflation Founder Stefan Rust. “The infrastructure supporting the NFT space is still developing. We are excited to be launching several new NFT oracles supported by Chainlink that help unlock innovative smart contract applications and incorporate high-quality NFT price data into the web3 infrastructure. This will contribute to the adoption and utility of the entire ecosystem,” he said.

The indexes are available on the Chainlink Marketplace and can stream data such as the collections’ current mode prices (the most common price per collections of NFTs over the last 7 days), the circulating supply, and the market caps (calculated as mode price * circulating supply) directly to smart contracts and web3 applications.

Truflation also added a unique feature on the Chainlink network that allows users to quickly add custom data streams and personalized indexes to on-chain oracles.

The Role of NFT Indexes

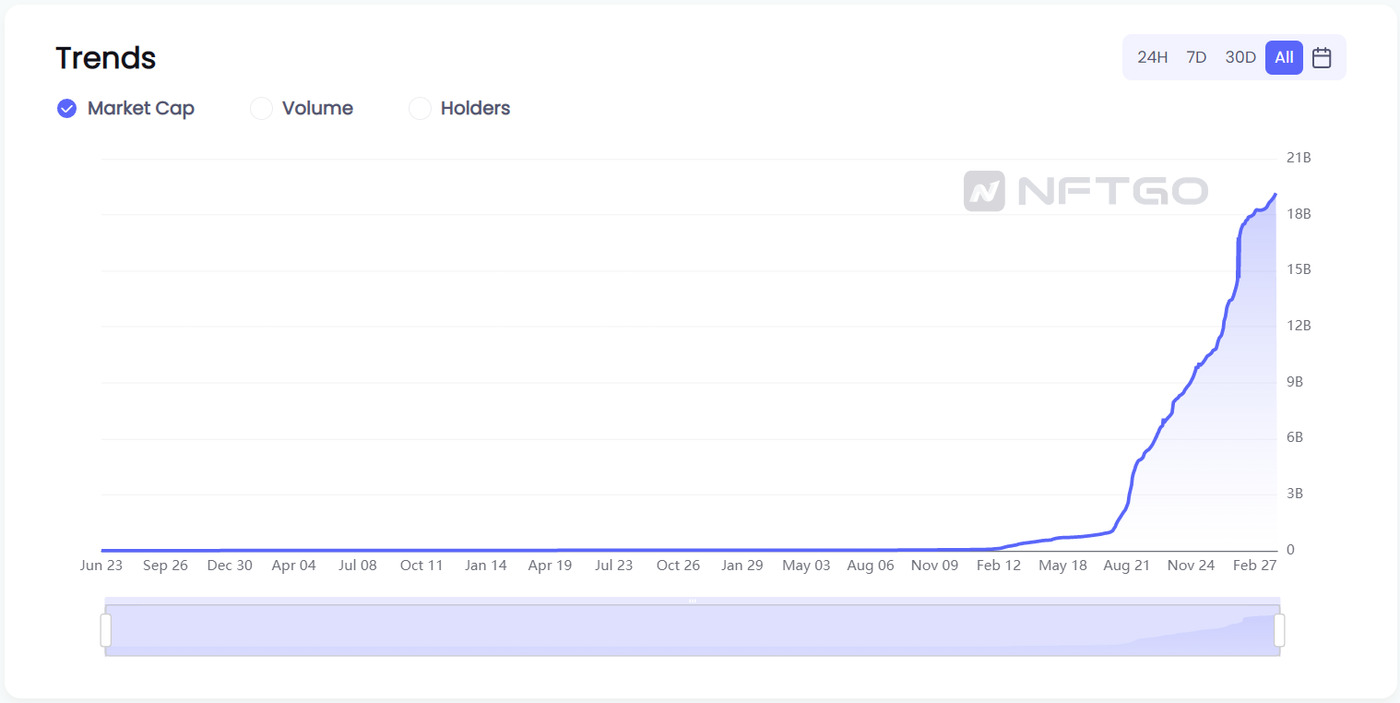

NFTs have gained incredible popularity in the last two years thanks to their unique ability to store and transfer the ownership of digital art, music, collectibles, and more on the blockchain. NFT price indexes aim to facilitate valuation, portfolio tracking, lending and borrowing, and the collateralization of non-fungible tokens (NFTs).

The Top 11 NFT Index

Previously, the team rolled out the Top 11 NFT, which consists of the 11 biggest NFT collections (ERC721) on Ethereum, updated every quarter to include the most popular collections without being affected by temporary outliers.

The oracle streams the price index benchmarked to January 1, 2022, its 24-hour percentage price change, and a 30-day percentage price change.

For Developers, By Developers

The individual NFT collection data supplied using Chainlink…

[ad_2]

Source link