Moderna Inc MRNA reports a Q2 EPS of $5.24compared to the $6.46 released a year ago, beating the consensus estimate of $4.59.

Revenue was $4.75 billion compared to $4.34 million a year ago, beating the consensus of $4.07 billion. Revenue declined nearly 22% sequentially from $6.1 billion. Product sales were $4.5 billion, +8% Y/Y primarily due to a higher average selling price due to customer mix.

The company incurred $499 million in inventory write-downs related to the expiration of the COVID-19 vaccine. The charge includes a loss on firm purchase commitments of $184 million and an expense of $131 million on unused external manufacturing capacity.

Operating income reached $2.45 billion compared to $3.06 billion a year ago. Moderna had $18.1 billion in cash, cash equivalents and investments.

Buy back: Moderna has approved an additional $3 billion share repurchase program. That $3 billion buyback program announced in February is ongoing and currently has approximately $1 billion outstanding.

Outlook: Moderna reaffirms approximately $21 billion in Advanced Purchase Agreements for 2022, including the recently announced agreement with the US government for 70 million doses.

Price promotion: MRNA shares are up 4.33% to $167.77 during the premarket session last check Wednesday.

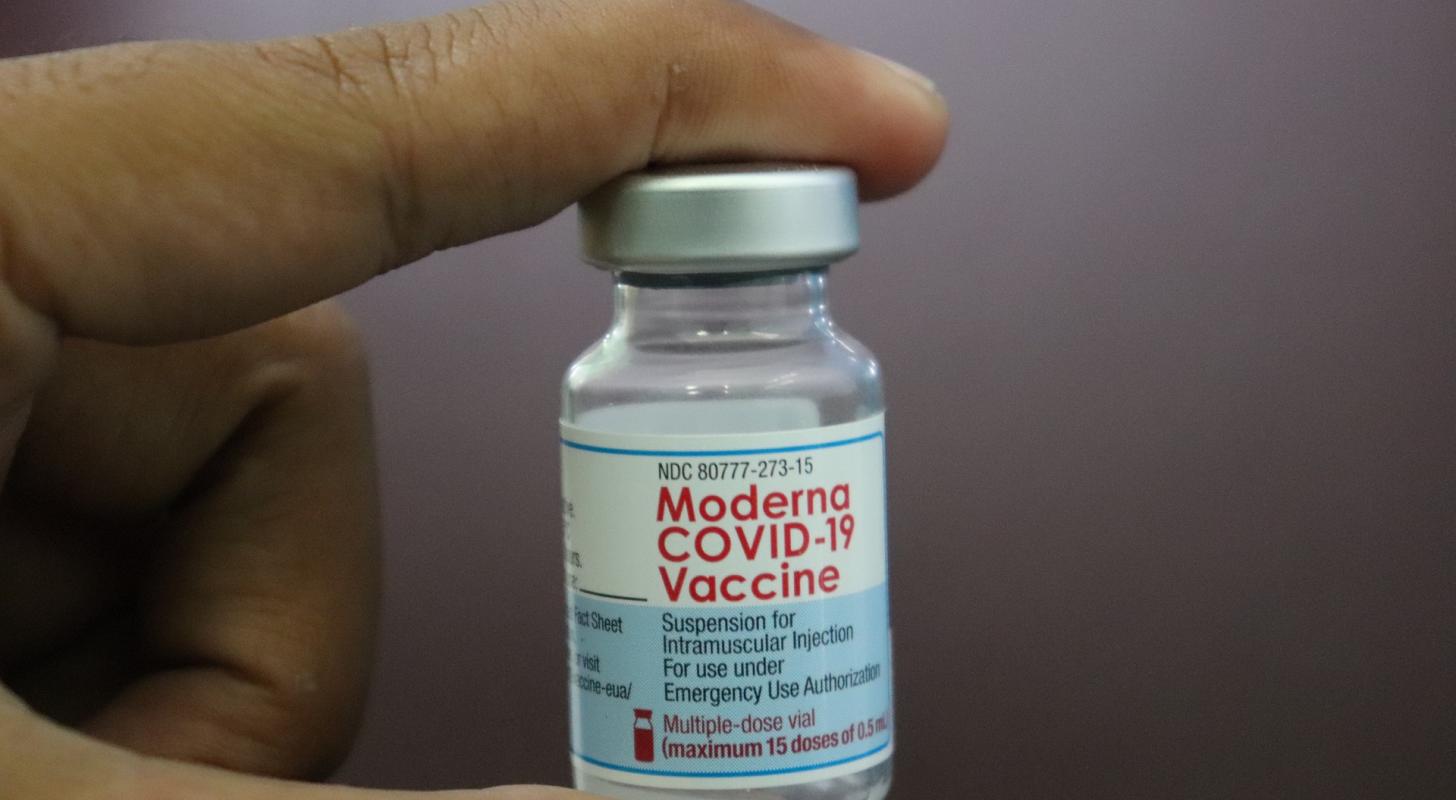

Photo by mufidpwt via Pixaby

[ad_2]

Source story