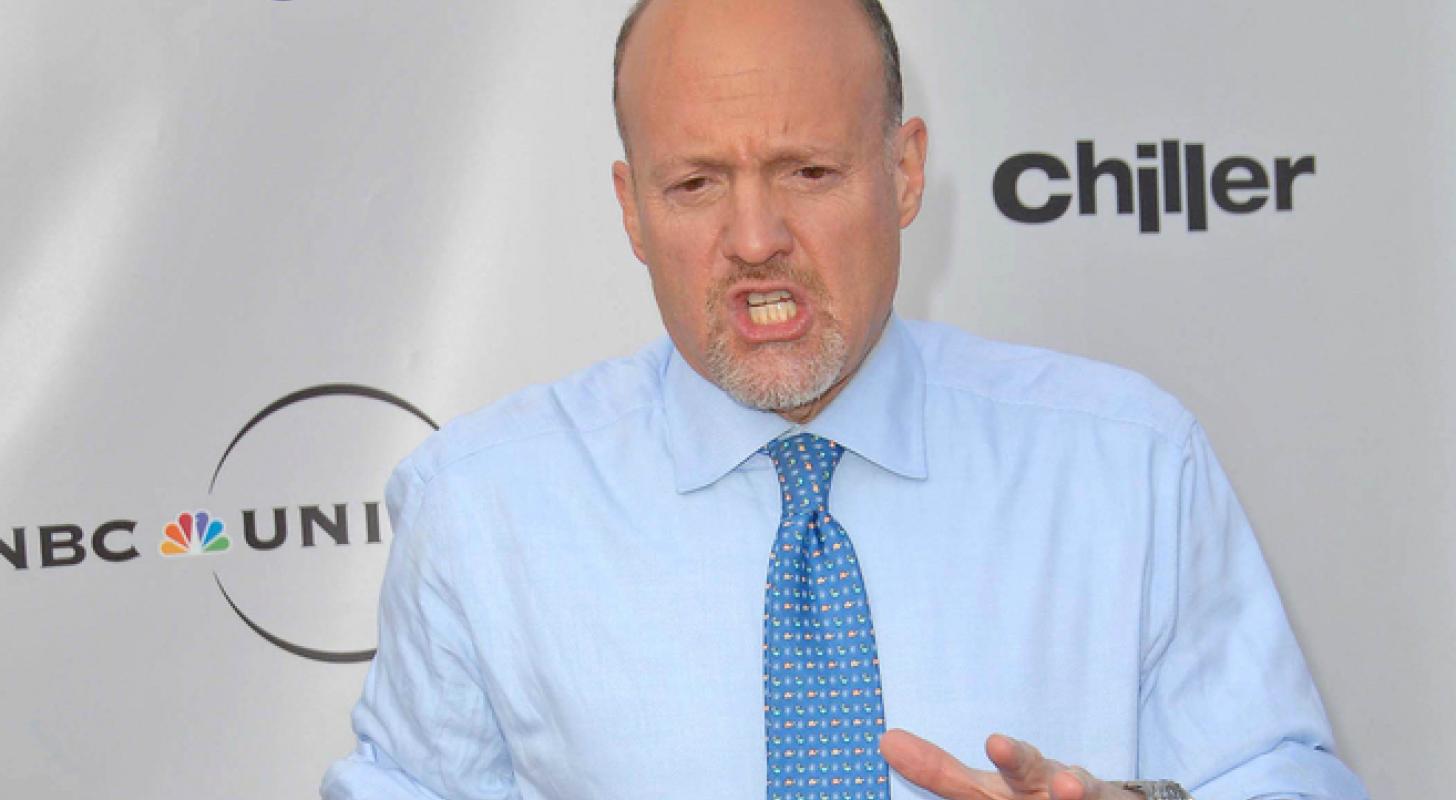

celebrities market commentator Jim Cramer believes a sell-off in tech stocks is overshadowing a bull market in other stocks.

“We had a very traditional bull market based on the dollar and interest rate spikes, both of which are great for stocks for a variety of reasons,” Cramer said according to to a CNBC report.

Also read: How to buy Visa (V) shares

“The relentless brawl in the Teslas and Salesforces and Amazons” obscures it, he added.

Major Wall Street indices fell on Thursday after US unemployment data showed the job market remains resilient, a factor seen as crucial to momentum the Those of the Federal Reserve future politics. Weekly jobless claims fell 15,000 to 190,000 while ongoing claims rose 17,000 to 1.647 million.

Price promotion: This is the SPDR S&P 500 ETF Trust SPY closed 0.73% lower during the Invesco QQQ Trust Series 1 QQQ 0.98% lost. Cramer pointed out that stocks of companies including visa inc v, Mastercard Inc MA, JPMorgan Chase & Co JPM and Boeing Co B.A bottomed out at the end of last year.

“These huge stocks have made monstrous happy moves for the past few months – what we’ve seen this week is just an orderly pullback to burn away their heavily overbought state,” he said.

In fact, some of these names have posted decent gains over the last month. Visa and Mastercard shares are up nearly 7%, while Boeing shares are up over 9% over the period.

“Remember, there are two tracks out there. The tech track that can’t seem to catch on is rooted in about 30% of the market, and the other track that took hold months and months and months ago,” Cramer added.

Continue reading: Fed’s Williams believes monetary policy has more work to do: ‘Crucial that we stay the course until the job is done’

[ad_2]

Source story