Enphase Energy Inc ENPH Stocks are trading higher. Raymond James upgraded the stock on Monday. The company also announced an expansion of its microinverter deployments, highlighting strong market trends.

What you should know: Raymond James Analyst Pavel Molkhanov upgraded Enphase to Outperform from Market Perform and announced a price target of $225, noting that the company is positive on the company for the first time in 10 years.

The upgrade is due in part to the stock’s year-to-date underperformance. Enphase shares are down more than 30% year-to-date and are down more than 10% over the past week.

The outperform rating is also driven by the company’s clean tech commitment in Europe.

“It is important that Europe came into being as Enphases leading growth driver in 2022, and we expect more of that in the coming years,” wrote analyst Raymond James in a new note to clients.

See also: Top 5 energy stocks that could take off in March

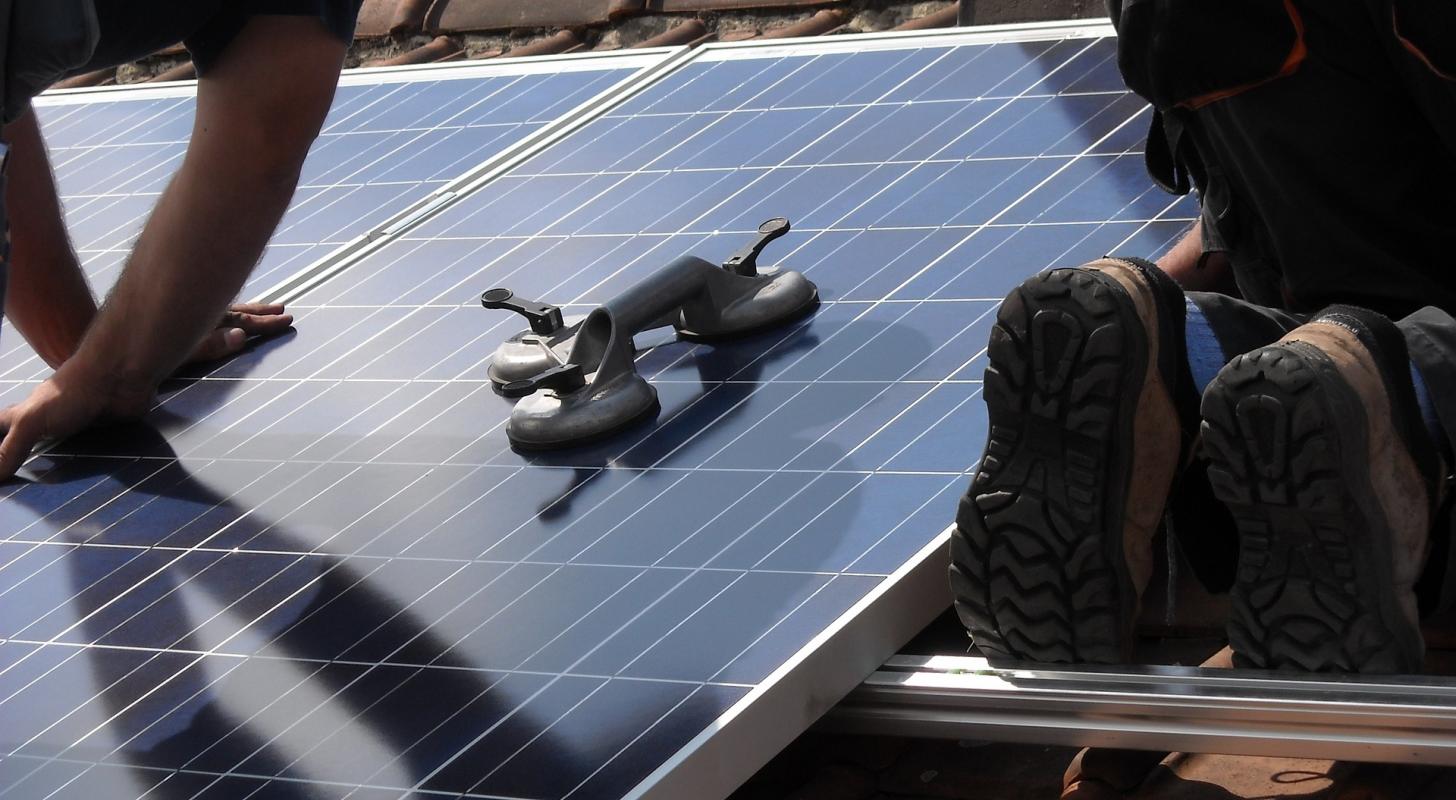

What else: Enphase also announced Monday that installers of Enphase products in Virginia are seeing increasing deployments of the company’s power systems powered by IQ8 microinverters.

“We are committed to innovation, quality and customer-centric service as we work to unlock a more sustainable future for all,” he said David RanhoffChief Commercial Officer of Enphase Energy.

enphase The Energy Storage Association and Wood Mackenzie estimate that the use of solar panels in residential buildings in Virginia is expected to increase by approximately 37% in 2023 compared to 2021. In addition, the use of batteries in residential buildings is expected to triple by 2026.

ENPH Price Action: Enphase has a 52-week high of $339.92 and a 52-week low of $128.67.

The stock is up 6.16% at $194.96 at the time of writing Gasoline Pro.

Photo: Maria Godfrida from Pixabay.

[ad_2]

Source story