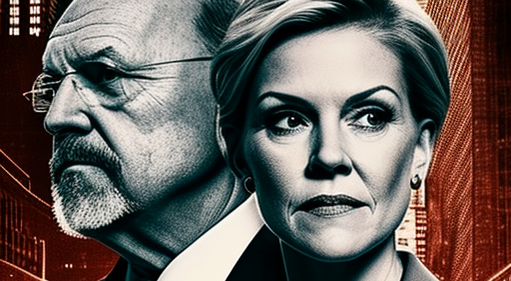

CNBC “Mad Money” host Jim Cramer agreed Senator Elizabeth Waren‘s (D fair) Criticism of banking regulation.

What happened: On Monday, Warren tweeted that bank executives were “begging for weaker prudential rules” and “reap what they sow.”

In response, Cramer said, “She’s right, and she’s right about shaming the examiners!”

Warren also expressed her desire to protect working people from further bank failures by reintroducing strong safeguards. In a tweet on Friday, she discussed her goal of returning banking to its primary function of taking deposits and lending money, saying, “This is boring.”

See also: The best financial services stocks right now

She highlighted her bipartisan bill, which provides regulatory measures against errant executives. “Hey, if you load that bank risky and the bank blows up, you’re going to lose that fancy bonus, you’re going to lose that big salary, you’re going to lose those stock options,” she said.

Warren criticized banking regulators for not doing enough and called on Congress to introduce safeguards. “We allowed regulators to take their eyes off the ball. Banking is a regulated industry for a reason, because it impacts the rest of the economy,” she said.

Why it matters: The risk taken by banks investing in long-dated government bonds has led to book losses in a rising interest rate environment and triggered the collapse of the US dollar Silicon Valley Bank And signature bank, with panicked depositors causing bank runs. The Treasury Department and Federal Reserve stepped in to protect these banks’ deposits, stave off contagion and calm markets.

Continue reading: Bill Ackman Says Government Response to SVB Collapse, Not Bailout: ‘People who screwed up will suffer the consequences’

This illustration was generated using artificial intelligence via MidJourney.

[ad_2]

Source story