Inflation has been a massive problem for almost every major country in the last year or so.

Consumers and businesses alike have felt the pain, with earnings for the past four quarters proving relatively lackluster. As inflation slows, it has pushed up US and other countries’ debt levels.

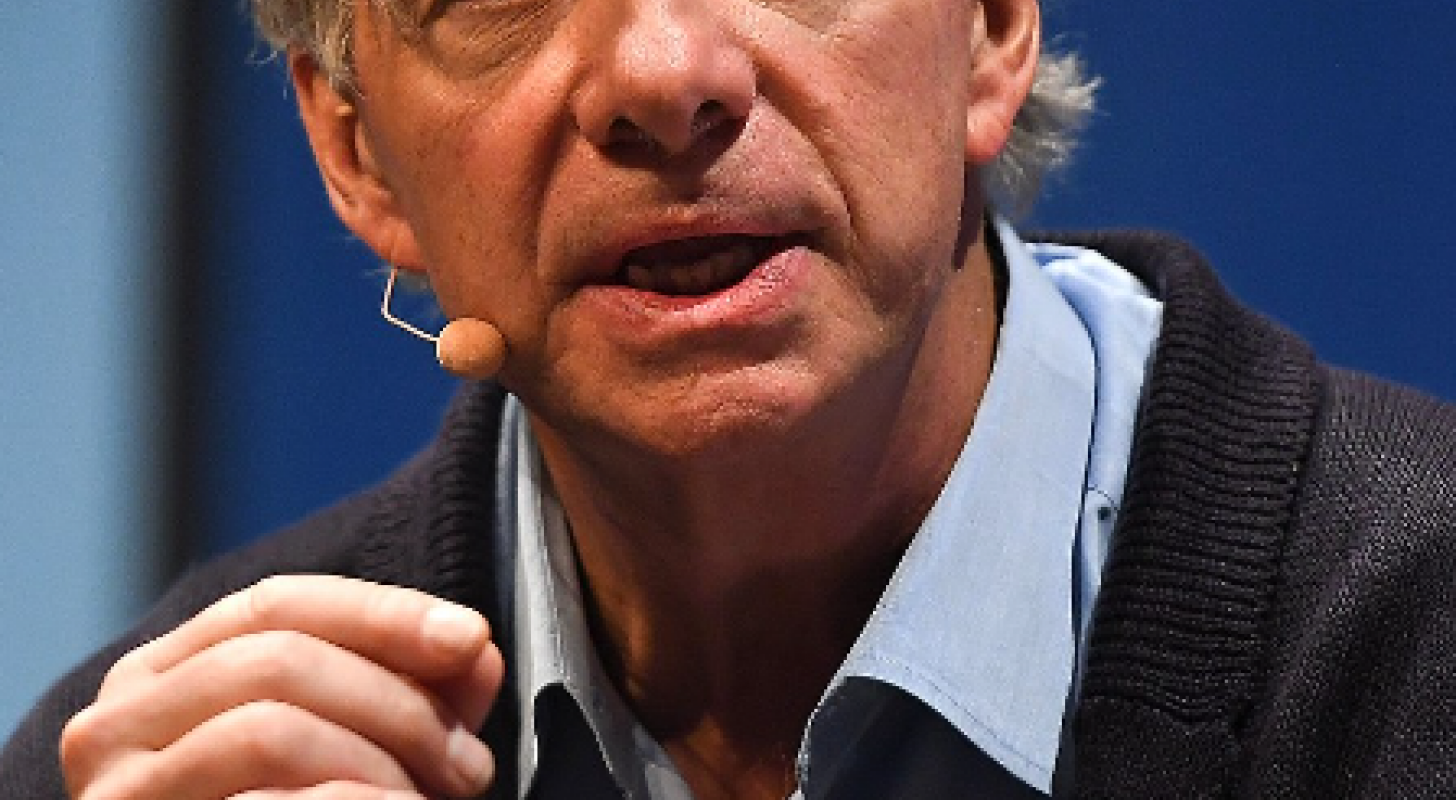

Between high inflation and a massive debt burden, the founder of the world’s largest hedge fund is sounding the alarm. Founder of Bridgewater Associates Ray Dalio has expanded his investment empire into one of the largest hedge funds in the world.

In a recent interview with CNBC, Dalio said: “Money as we know it is at risk [because] we’re printing too much, and it’s not just affecting the United States.”

Dalio ruled out bitcoin as a solution because he says it has proven to be too volatile, unrelated and many industries are more interesting than crypto.

To stay up to date on top startup investments, Sign up for Benzinga’s Startup Investing & Equity Crowdfunding Newsletter

While Bitcoin isn’t the answer, a digital currency could be one. “I think what… would be best would be an inflation-linked coin,” Dalio said, noting that what’s closest to his vision in the market is an inflation-linked index bond in the form of a currency.

This is in stark contrast to recent narratives surrounding digital currencies and crypto. Sentiment regarding crypto and other digital currencies is likely at an all-time low due to the recent collapses of FTX, Celsius Network LLC, BlockFi and several others. But bitcoin is up as much as 50% since its November lows, meaning there could be an opportunity for investors if sentiment picks up — even if it doesn’t function as a currency.

A few startups could benefit from this recovery in sentiment, including game flip. Gameflip is a $140+ million startup for its non-fungible token (NFT) and gaming assets marketplace that could benefit from a recovery in crypto-based assets even if…

[ad_2]

Source story