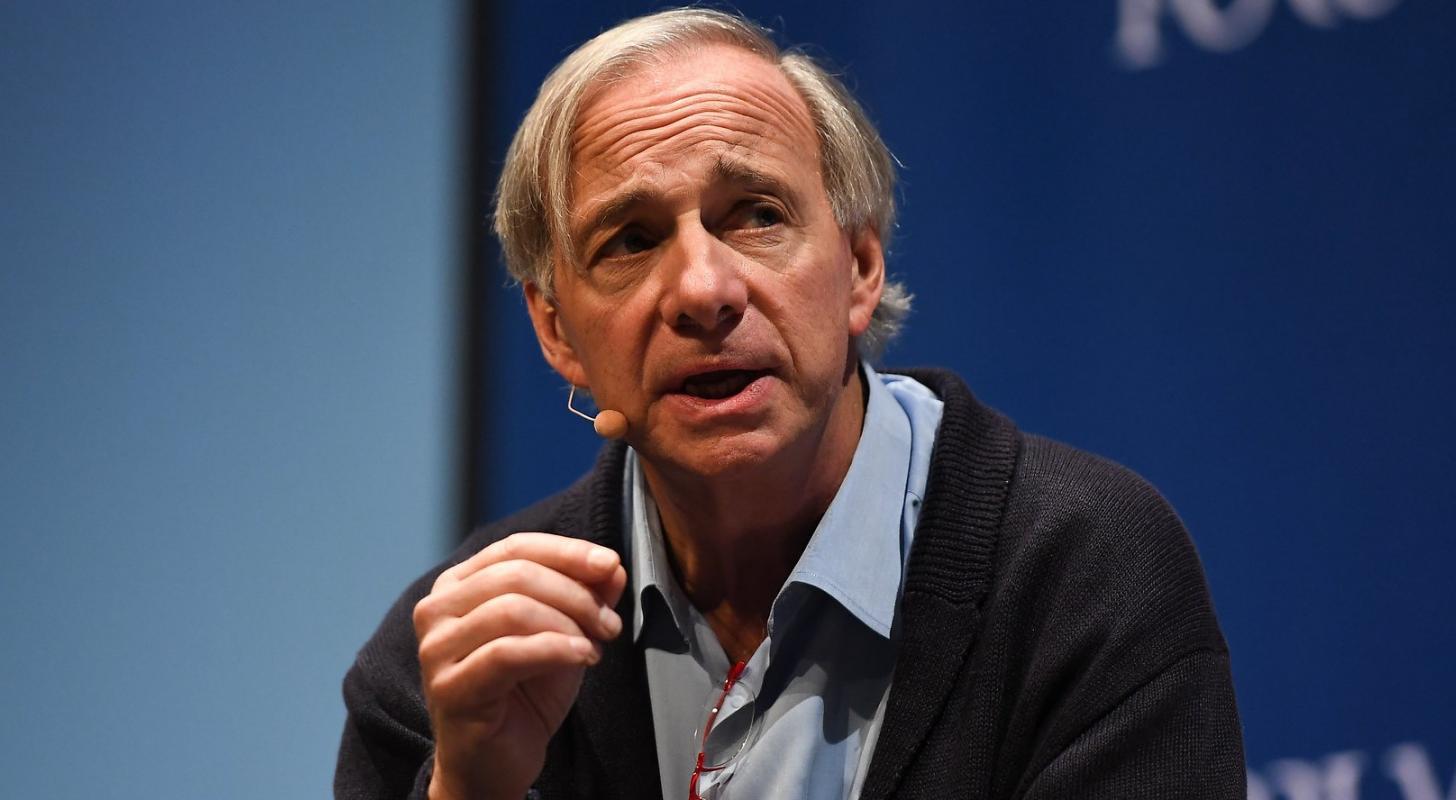

Bridgewater Associates is an American hedge fund founded by a billionaire investor Ray Dalioit is the world’s largest hedge fund with approximately $23.6 billion in assets under management (as of August 2022).

If you want to invest like Bridgewater Associates, here are three dividend stocks that offer future growth potential as well as passive income.

Go to: Have Tech Stocks Bottomed? The world’s largest hedge fund’s holdings suggest yes

AT&T Inc T offers a dividend yield of 6.12%, or $1.11 per share, and pays annually quarterly, with a mixed track record of increasing its dividends. AT&T is the third largest wireless carrier in the United States, connecting 68 million postpaid and 17 million prepaid phone customers.

AT&T delivered subscriber growth near the second quarter’s record with 316,000 net adds at AT&T Fiber, bringing total net adds to nearly 2.3 million over the past two years, including 10 consecutive quarters of more than 200,000 net adds.

Pfizer Inc PFE offers a dividend yield of 3.27%, or $1.60 per share annually using quarterly payments, with a strong track record of growing its dividends over the past 11 years. Pfizer is one of the world’s largest pharmaceutical companies with annual sales of nearly $50 billion (excluding COVID-19 vaccine sales).

Through March 2022, Pfizer bought $2 billion, or 39.1 million shares, at an average price of $51.10 per share, with no plans to buy back more shares in the second half of the year.

Schlumberger Limited SLB offers a dividend yield of 1.90%, or 70 cents per share annually through quarterly payments, with no increase in dividends over the past year. Schlumberger is the largest oilfield services company in the world with expertise in a variety of disciplines including reservoir performance, well construction, production improvement and, most recently, digital solutions.

In the second quarter of 2022, Schlumberger reported a 14% sequential revenue increase, with annual revenue growth of…

[ad_2]

Source story